Ethereum Analysis: A Quick Look at Market Sentiment (2020)

In this post, we will analyze Ethereum sentiment metrics & look at the driving factors in its success so far this year.

Returns

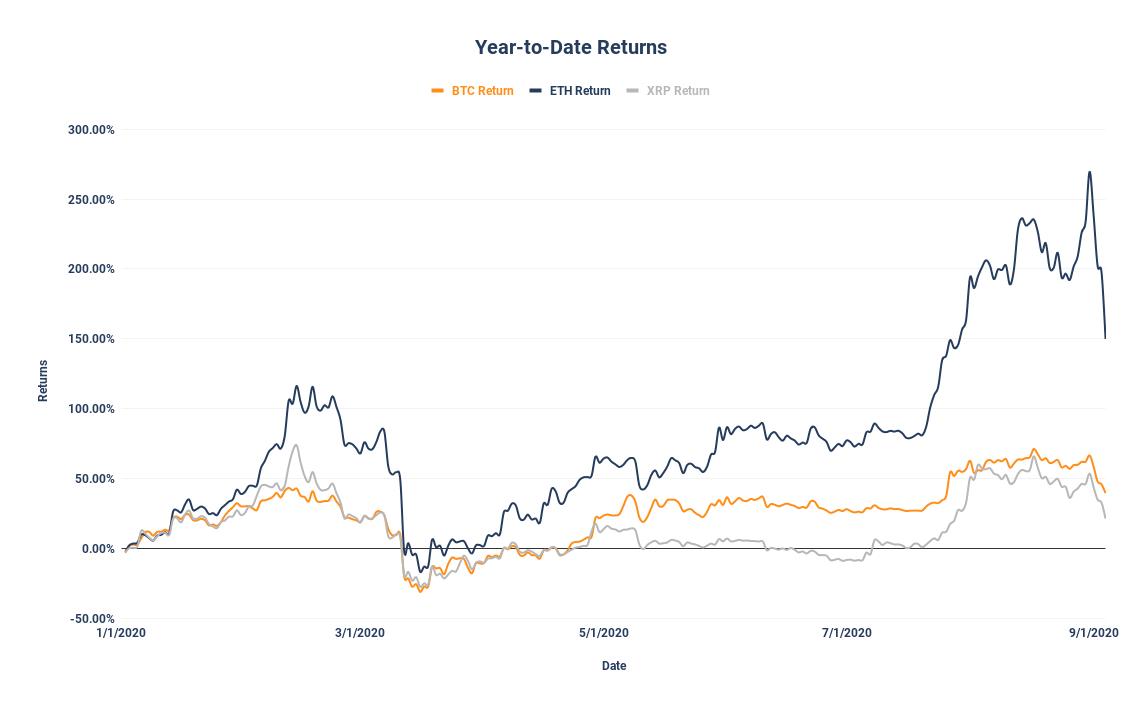

Despite a global pandemic, Crypto returns have been positive throughout most of the year with Ethereum up 150% in 2020.

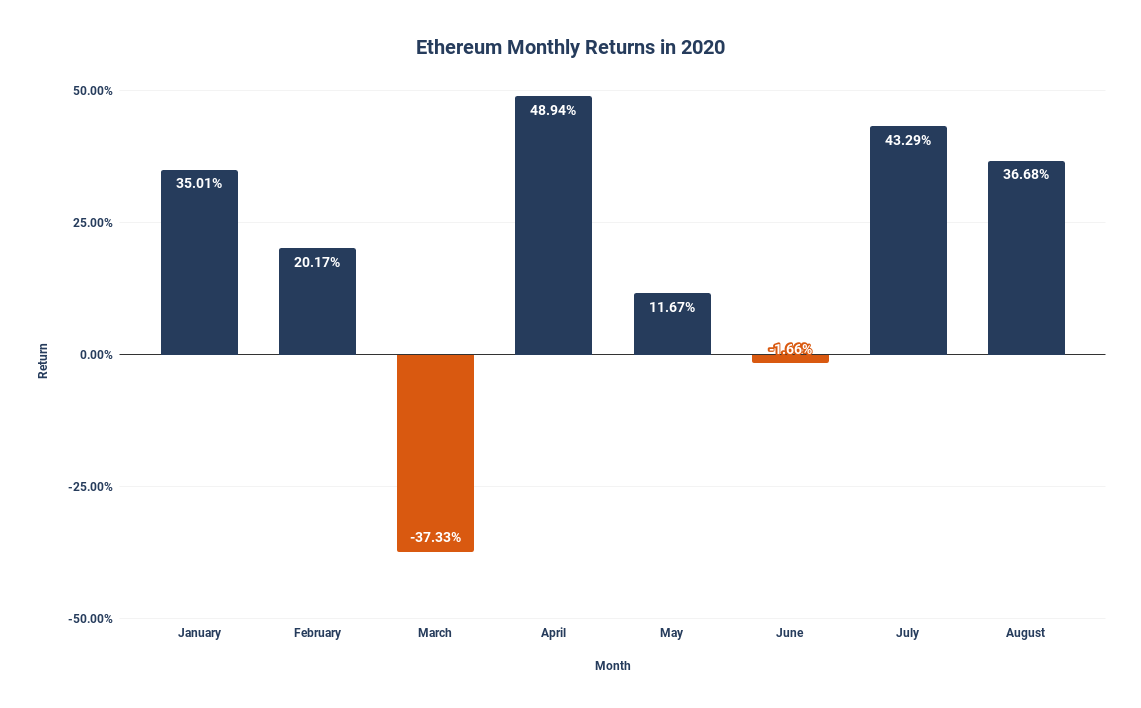

ETH has seen positive double digits returns in each month besides the sell off in March & a slight dip in June.

It’s worth noting that March’s -37% return was followed by a 49% return in April (highest monthly return in 2020), and June’s -1.6% dip was followed by a 43% return in July (second highest return in 2020).

Investors in full “buy the fu**** dip” mode.

With ETH being up 150%, it has outperformed BTC (40%) & XRP (22%).

This is largely due to the surge of new interest surrounding DeFi.

Given that the majority of decentralized finance networks are built on top of Ethereum, it’s safe to say that DeFi is a driving factor in it’s success this year.

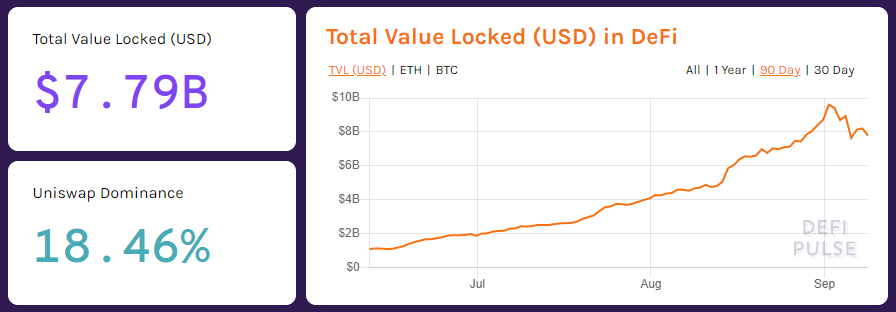

Total Value Locked (TVL) in DeFi has drastically increased from $690M in January to a new record high of $9.6B on September 1st.

Ethereum Sentiment

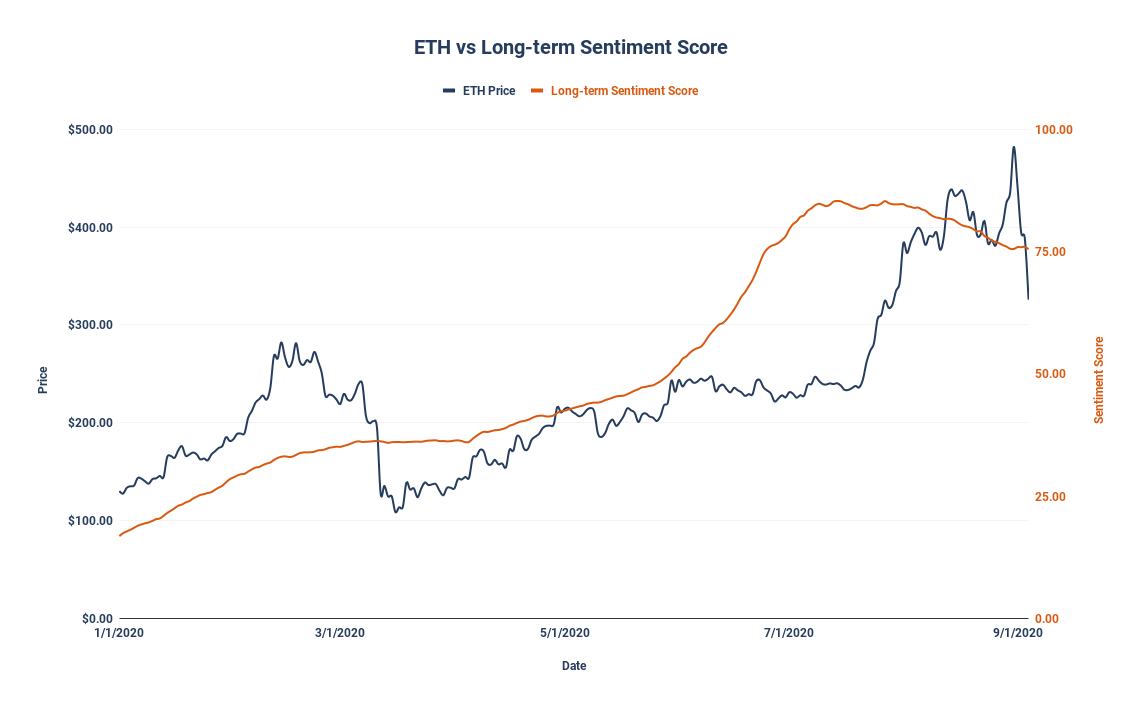

While the price of ETH consolidated around $240 for nearly two months, the Long-term Sentiment Score set a new high of 85.33 on July 14th.

One week later, Ethereum started breaking out of its consolidation range. It eventually climbed up to $482 on August 31st, a new yearly high.

That was a return of 270% before the market turned around.

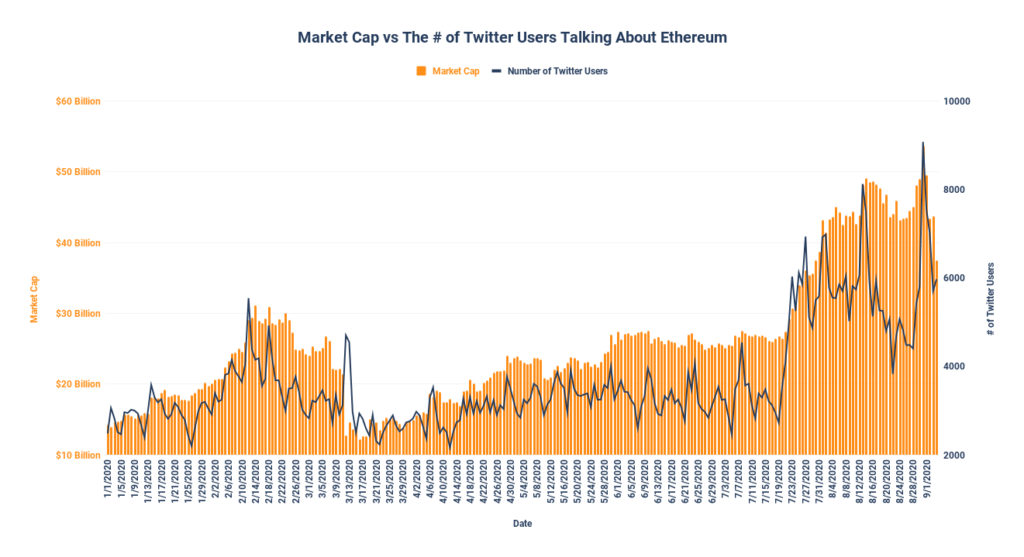

The number of Twitter users talking about Ethereum hit a new high of 9,000, which is a 260% increase from 2500 in January.

This high was set on August 31st, the same day that Market cap hit its yearly high of $53B.

These two metrics have shown a strong correlation of 0.84.

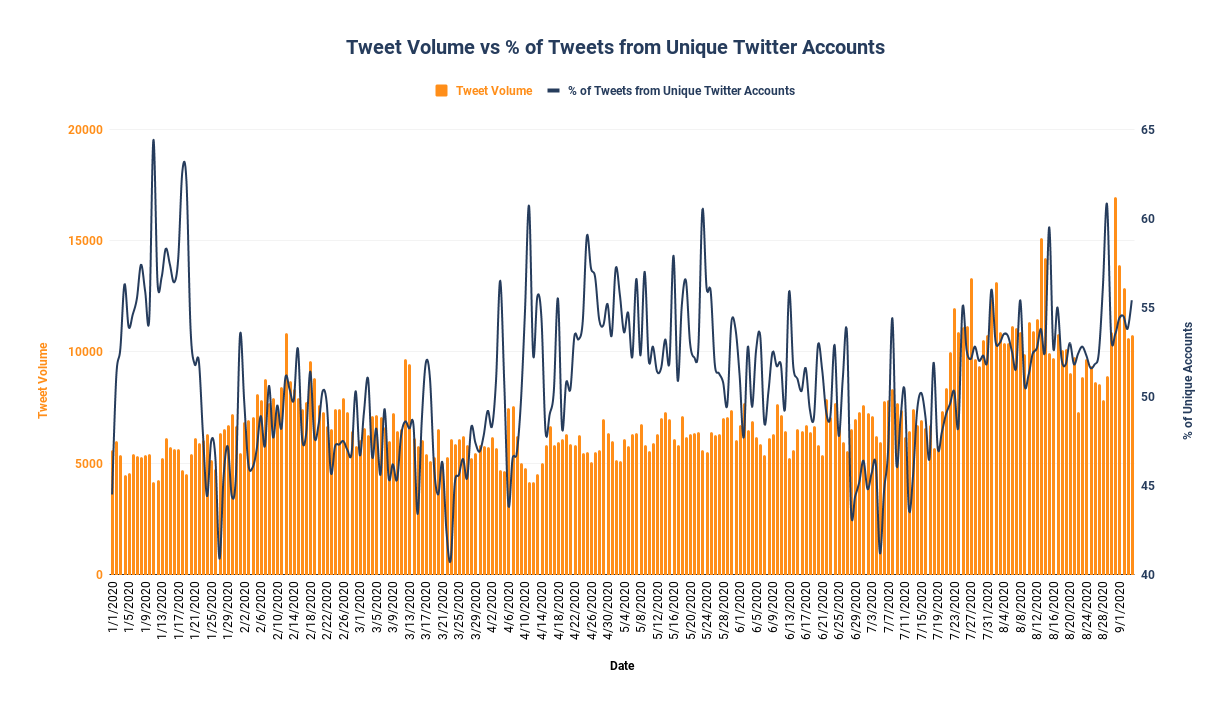

In addition to the amount of Twitter conversions around Ethereum increasing, the percentage of those tweets are coming from an increased number of unique Twitter users since July.

That percentage hit 60.8% on August 31st, just shy of January’s 64.4%.

Conclusion

Several key metrics, including Ethereum sentiment, in line with prices hitting new yearly highs, was suggestive of a local market top.

Subscribe to Markets Science for more in depth analysis on the Cryptocurrency market.